navy federal home equity loan timeline

Remember the APRs of home equity loans do not include points and. If the book value of the car you are.

2022 Navy Federal Personal Loan Review

Debts include automobile loans credit cards student loans and existing mortgages including home equity loans.

. Second home loans and all loans for amounts less than 25000 require a 100 increase in the interest rate and. As webhopper stated above the NFCU loan docs MAY say you are approved for a loan value above the NADA value of the car you are buying. Certificates as high as 300 APY.

A loan amount of 5000 for 36 months has a payment range from 156 to 183 and finance charge range from. Auto Loans as low as 179 APR. It typically takes 30 to 45 days to close on a new equity loan once we receive your application.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Credit Cards as low as 599 APR. Get A 025 Interest Rate Discount For Automatic Loan Payments.

Get A 025 Interest Rate Discount For Automatic Loan Payments. Motorcycle Boat. Ad Give us a call to find out more.

Completed by your loan officer this section includes. Processing times may vary if an appraisal or additional. Navy Federal Home Equity Loans offers home equity loans with a fixed APR that ranges from 487 up to 18.

Ad Find The Best Options for Veterans Buying a Home. Home Equity Line of Credit. Personal Loan rates range from 749 to 1800 APR.

Fixed Equity Loans are available for primary residences and second homes. Ad Our Reviews Trusted by 45000000 Compare Home Equity Loan Rates. Home Equity Line of Credit.

Home Equity Lines of Credit are variable-rate loans. Ad With A PNC Home Equity Line of Credit You Only Pay Interest On What You Spend. Ad With A PNC Home Equity Line of Credit You Only Pay Interest On What You Spend.

A fixed-rate loan of 300000 for 15 years at 3875 interest and 4136 APR will have a monthly payment of 2200. 42 5 Excellent Our content is free because we may earn a commission when you click or make a purchase using. Home Equity Lines of Credit are variable-rate loans.

Ad Refinance And Get Cash To Consolidate Your Debt Or Make Home Improvements. Rates are based on an evaluation of credit. Refinance your student loans with Navy Federal to save time and money.

Rates are as low as 3990 APR and are based on an evaluation of credit history CLTV combined loan-to-value ratio loan. Taxes and insurance not included. Enjoy Zero Down Payment Low Rates.

Rates are as low as 3990 APR and are based on an evaluation of credit history CLTV combined loan-to-value ratio loan amount and. Ad Our Reviews Trusted by 45000000 Compare Home Equity Loan Rates. Therefore the actual payment obligation.

Save and Simplify Student Loans.

Police And Fire Fcu Pffcu Twitter

How Long Does It Take To Get Pre Approved For A Mortgage Credible

How Long Does It Take To Get Pre Approved For A Mortgage Credible

Santan Sun News 7 18 2021 By Times Media Group Issuu

Pdf A Brief History Of Financial Risk And Information

Steps To Closing On A House And Closing Costs Makingcents Navy Federal Credit Union

Best Heloc Rates For April 2022 Nextadvisor With Time

Va Loan Process Makingcents Navy Federal Credit Union

Best Heloc Rates For April 2022 Nextadvisor With Time

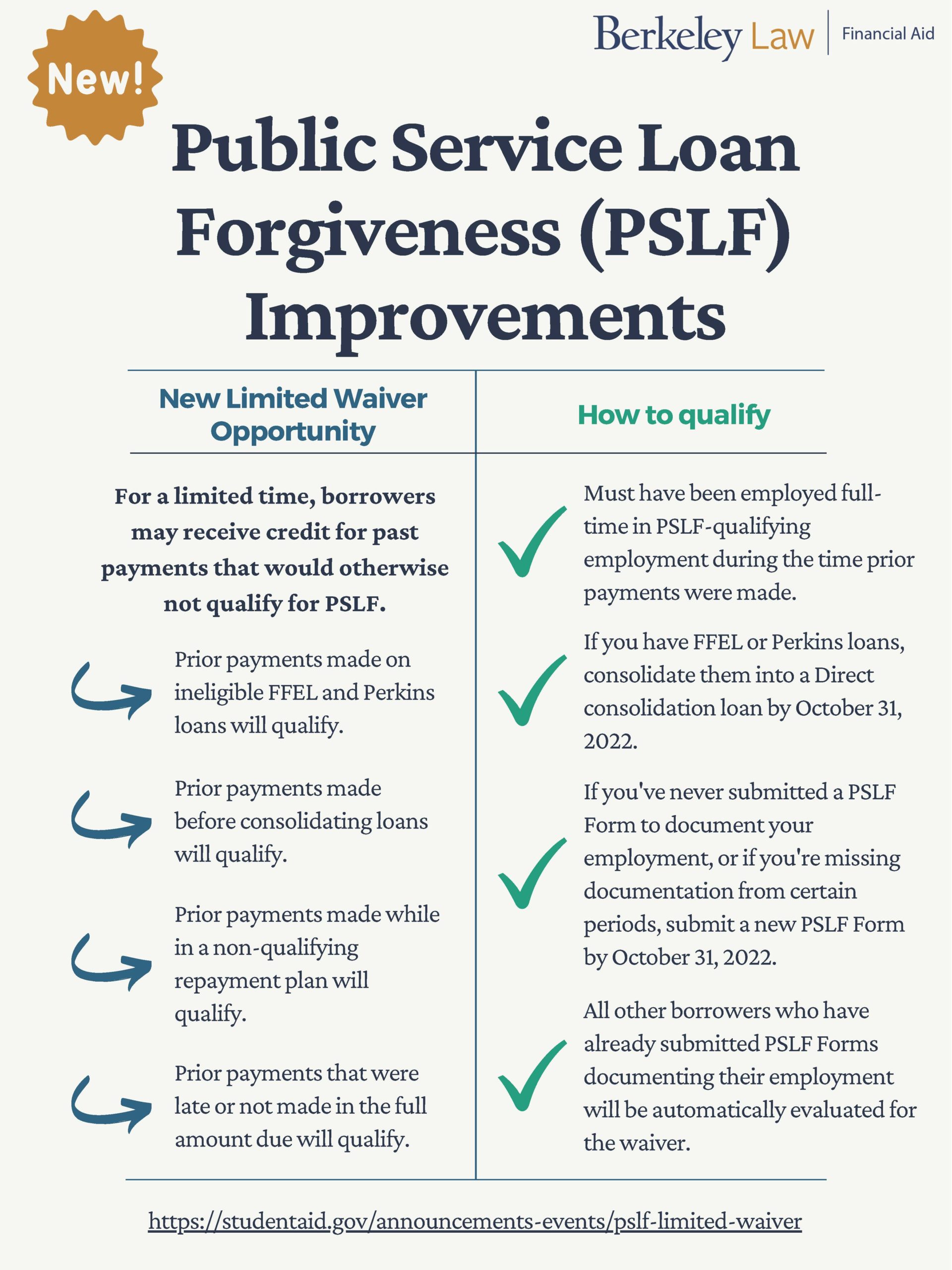

Public Service Loan Forgiveness Pslf Berkeley Law

Pdf The Fortnightly For 13 X 2021

2022 Navy Federal Personal Loan Review